Investment research has entered a new era with Fiscal.ai (formerly FinChat), an AI-powered platform that's revolutionizing how European investors analyze stocks. After securing $13 million in funding and attracting over 350,000 global users, Fiscal.ai positions itself as a game-changing alternative to expensive Bloomberg terminals. What makes this platform particularly compelling for EU investors is its comprehensive coverage of European markets combined with conversational AI that understands complex financial queries in plain language.

We tested Fiscal.ai extensively to determine whether it delivers genuine value for European investors or simply repackages existing AI technology with a financial wrapper. Our analysis reveals a platform that excels in fundamental analysis and global market coverage while presenting some limitations that specific investor types should consider carefully.

What We Like About Fiscal.ai

Pros:

- Revolutionary AI Copilot that outperforms ChatGPT by 2-4x on financial questions

- Comprehensive coverage of major European exchanges (LSE, Euronext, Xetra, SIX)

- Proprietary segment and KPI data for 2,000+ companies unavailable elsewhere

- Institutional-quality S&P Market Intelligence data at retail prices

- Free tier includes robust features for evaluation

- 15% discount available with code EUINVEST at checkout

What We Don't Like

Cons:

- Monthly AI prompt limits even on paid tiers (100-500 prompts)

- Interface could be sleeker looking

- No mobile app

What Fiscal.ai Is Known For

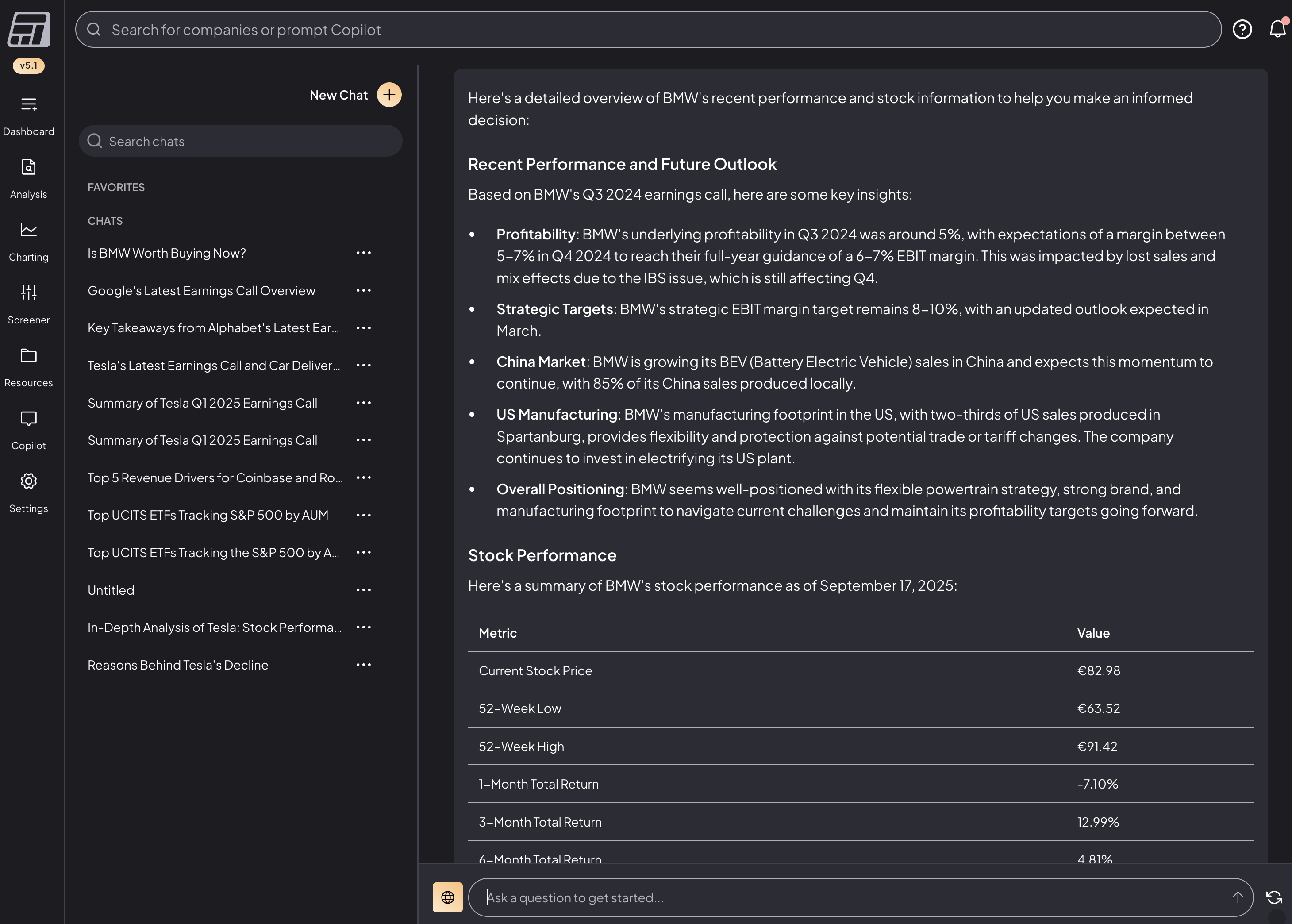

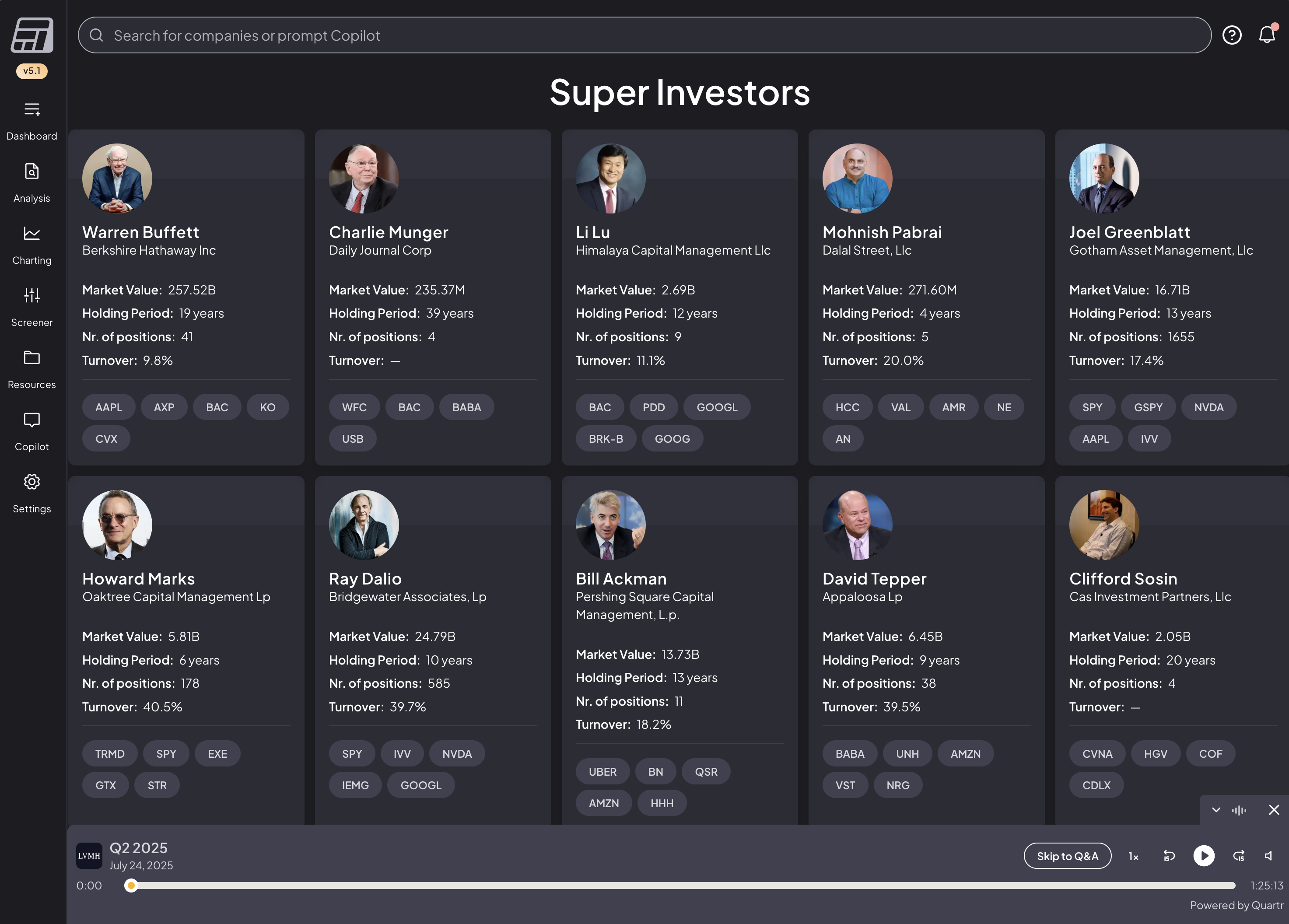

Fiscal.ai has built its reputation on democratizing institutional-grade financial analysis through conversational AI. The platform's standout feature is its AI Copilot, which acts like having a professional financial analyst on demand. You can ask questions like "Compare ASML's gross margins to semiconductor peers over five years" and receive comprehensive, sourced responses within seconds.

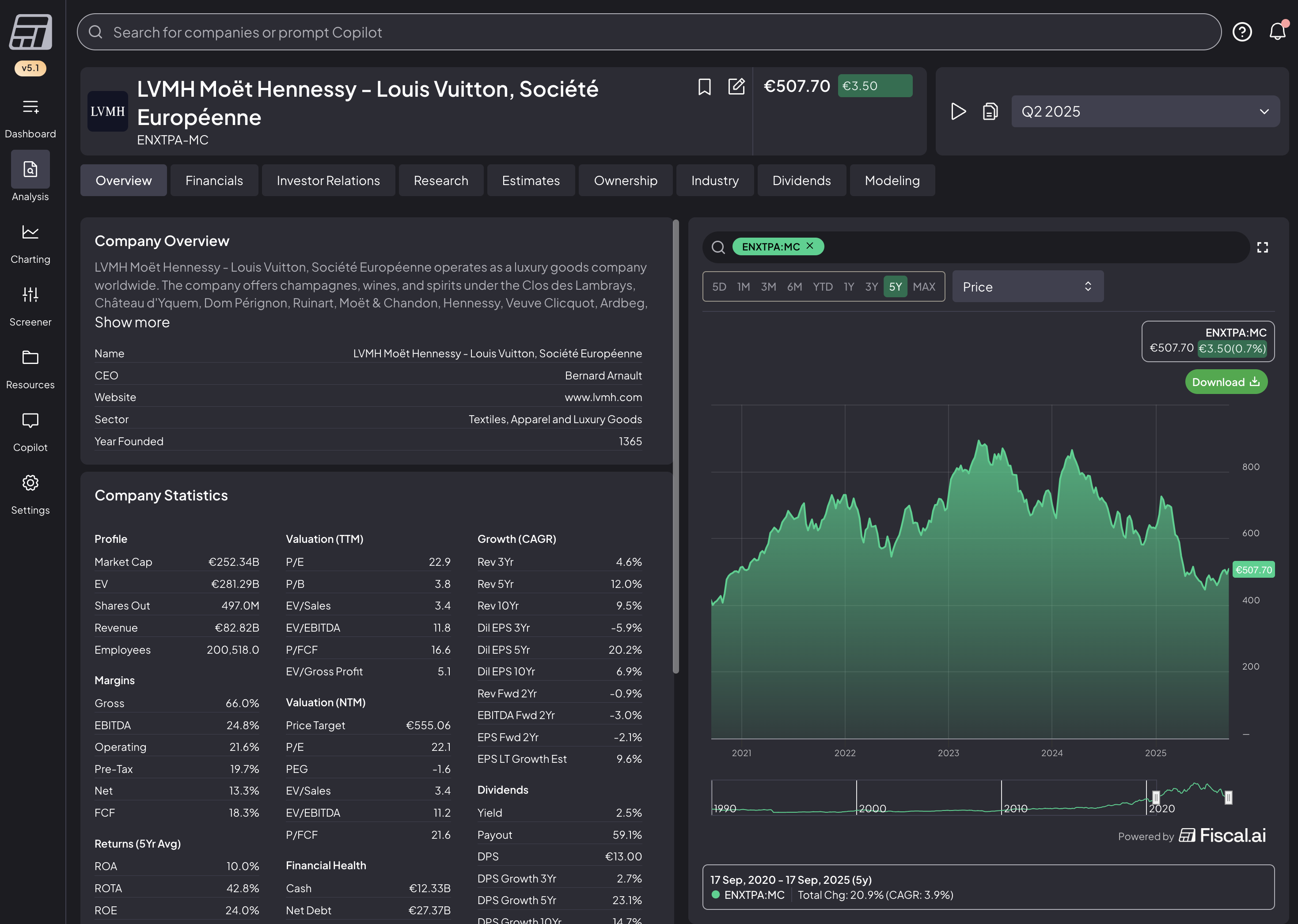

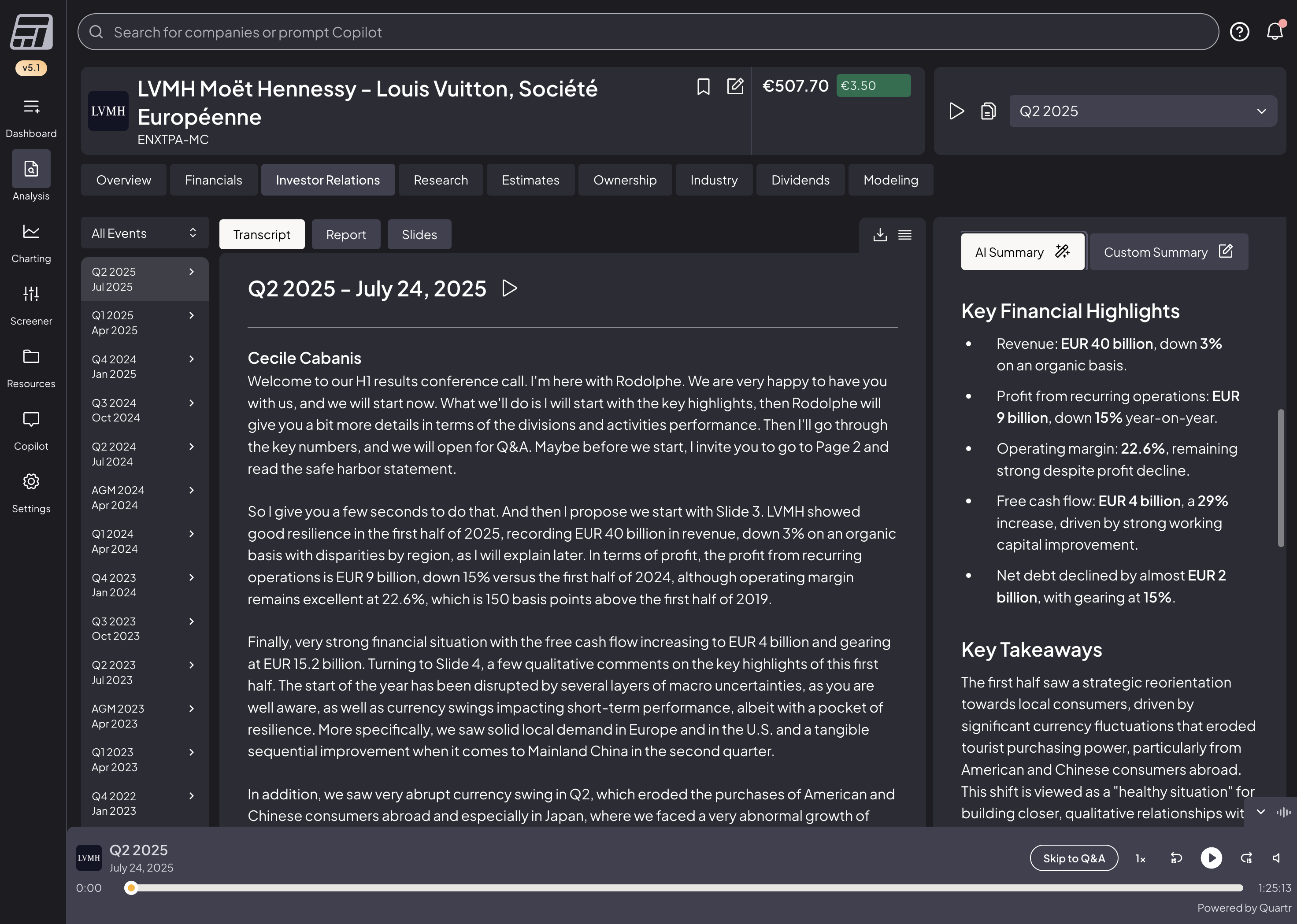

What sets Fiscal.ai apart from generic AI tools is its direct connection to S&P Market Intelligence data covering 100,000+ global companies. This means you're getting current, institutional-quality information rather than outdated training data. The platform particularly shines in its proprietary segment database, providing granular business unit metrics that traditionally require expensive terminals or hours of manual extraction.

Special Offer for EU Investing Hub Readers

EU investors can access Fiscal.ai at a 15% discount through our exclusive partnership. Use our link or enter code EUINVEST at checkout to save on any subscription tier. This discount applies to both monthly and annual plans, making the already competitive pricing even more attractive for European investors seeking professional-grade research tools.

Fees and Pricing Structure

Fiscal.ai offers four subscription tiers designed to accommodate different investor profiles. The free tier provides surprisingly robust capabilities, including 5 years of financial data and 10 monthly AI prompts, sufficient for casual investors to evaluate the platform's utility.

The Plus tier at $24/month ($240 annually with 20% discount) represents optimal value for serious retail investors. This tier unlocks 10 years of historical data, 100 AI prompts monthly, portfolio management tools, and full access to the proprietary segment database. When you consider that Bloomberg Terminal costs over $2,000 monthly, Fiscal.ai's pricing becomes remarkably attractive. For traditional analyst-driven stock research as an alternative or complement, Seeking Alpha offers several subscription tiers starting at $269/year.

Professional investors and small funds typically choose the Pro tier at $64/month ($640 annually), which provides 500 AI prompts, unlimited dashboards, 20+ years of historical data, and analyst revision tracking. Even at this level, you're paying less than 3% of a Bloomberg subscription while accessing comparable fundamental analysis capabilities.

Safety and Data Quality

Fiscal.ai sources its financial data from S&P Market Intelligence, one of the most trusted providers in institutional finance. This partnership ensures data accuracy and reliability that matches professional-grade platforms. The company updates earnings data within one hour of releases and maintains real-time synchronization with official filings.

The platform has raised $13 million from reputable venture capital firms and counts industry leaders like Jan Van Eck (CEO of VanEck Asset Management) among its endorsers. While Fiscal.ai doesn't hold client funds or execute trades, reducing regulatory complexity, we recommend verifying all AI-generated insights before making investment decisions.

Trading Experience and Platform Features

The Fiscal.ai interface prioritizes efficiency over aesthetic complexity, featuring a clean design that emphasizes functionality. Upon logging in, you're presented with a command bar for AI queries, customizable dashboards for tracking portfolios, and quick access to recent research.

The AI Copilot experience feels genuinely conversational. Unlike traditional screeners requiring specific syntax, you can ask questions naturally: "Which European tech companies have the highest R&D spending as a percentage of revenue?" The system maintains context across queries, enabling follow-up questions that build on previous responses.

Creating custom dashboards proves intuitive, though we encountered performance slowdowns when adding multiple metrics simultaneously. The platform excels at fundamental analysis but lacks advanced charting tools, making it less suitable for technical traders who rely on indicators and pattern recognition.

Supported Markets and Assets

Fiscal.ai provides comprehensive coverage across major global exchanges, with particular strength in European markets. The platform covers the London Stock Exchange, all Euronext markets (Paris, Amsterdam, Brussels, Lisbon, Milan, Dublin, Oslo), Frankfurt Stock Exchange/Xetra, and SIX Swiss Exchange. This extensive European coverage matches or exceeds most competing platforms.

The asset coverage focuses primarily on public equities, with over 100,000 global securities available for analysis. While the platform includes some ETF and ADR data, coverage for bonds, commodities, and cryptocurrencies remains limited. This positions Fiscal.ai as optimal for equity-focused investors rather than multi-asset portfolio managers.

Who Fiscal.ai Is Best For

Fiscal.ai proves ideal for fundamental investors who prioritize research efficiency and data accessibility. European investors benefit particularly from the platform's comprehensive EU market coverage and multi-language AI support. The tool suits long-term investors, value investors analyzing financial metrics, and professionals seeking Bloomberg alternatives at reasonable prices. Check out our review of our top recommended broker for EU investors.

The platform works exceptionally well for investors who appreciate AI-assisted research and want to save hours on manual data extraction. If you regularly analyze earnings reports, compare sector metrics, or track business segment performance, Fiscal.ai's capabilities will transform your workflow.

How Fiscal.ai Compares to Seeking Alpha

Seeking Alpha Premium costs $239 annually and excels in community-generated content with 18,000+ contributors. However, it lacks Fiscal.ai's AI capabilities and offers limited European coverage. Seeking Alpha suits investors who value diverse human perspectives, while Fiscal.ai better serves those prioritizing data-driven analysis and efficiency.

Unique Position

Fiscal.ai occupies a unique position as the only platform combining institutional-grade data, conversational AI specialized for finance, and comprehensive global coverage at retail prices. Unlike generic AI tools like ChatGPT or Gemini, Fiscal.ai connects directly to current financial databases and understands investment context. The proprietary segment data and KPI tracking capabilities remain unmatched by competitors.

Final Verdict

Fiscal.ai represents a genuine breakthrough in democratizing institutional-quality investment research. For European investors, the combination of comprehensive EU market coverage, revolutionary AI capabilities, and competitive pricing creates compelling value. The platform transforms hours of manual research into minutes of conversational queries while maintaining data quality that matches professional terminals. ETF investors will also appreciate the insights the platform provides.

We particularly appreciate the proprietary segment data that reveals granular business unit performance, critical for analyzing diversified European companies. The free tier's robust features enable risk-free evaluation, while the Plus tier at $24/month offers exceptional value for serious investors. With our exclusive 15% discount using code EUINVEST, the platform becomes even more attractive.

However, potential subscribers should consider the reported customer service issues, technical limitations for active traders, and AI prompt restrictions. The platform best serves fundamental investors prioritizing research efficiency over technical analysis or alternative assets. Despite these limitations, we believe Fiscal.ai delivers transformative value for European investors ready to embrace AI-powered investment research.

Frequently Asked Questions

Does Fiscal.ai cover European stock markets?

Yes, Fiscal.ai provides comprehensive coverage of major European exchanges including the London Stock Exchange, all Euronext markets (Paris, Amsterdam, Brussels, Milan, Dublin, Oslo), Frankfurt Stock Exchange/Xetra, and SIX Swiss Exchange. The platform offers the same institutional-quality data for European stocks as it does for US equities.

How does Fiscal.ai's AI differ from ChatGPT?

Fiscal.ai's AI Copilot is specifically trained on financial data and connects directly to S&P Market Intelligence databases covering 100,000+ companies. According to FinanceBench testing, it scores 2-4 times higher than ChatGPT on financial questions. Unlike ChatGPT, Fiscal.ai provides current market data with citations to original sources.

What's included in the free tier?

The free tier includes 5 years of financial data, 10 AI prompts monthly, access to global markets, basic charting capabilities, and limited dashboard features. It's sufficient for casual investors to evaluate the platform and conduct basic research on individual stocks.

Is the 15% discount stackable with other offers?

The EUINVEST discount code provides 15% off any subscription tier and can be applied to both monthly and annual plans. This discount typically cannot be combined with other promotional offers. Annual subscriptions already include a 20% discount, and the EUINVEST code applies on top of this savings.

How accurate is the AI-generated analysis?

Fiscal.ai's responses are generally highly accurate due to direct integration with S&P Market Intelligence data. However, we recommend verifying all AI-generated insights before making investment decisions. The platform provides citations for all data points, allowing you to trace information back to original sources.

Does Fiscal.ai offer mobile apps?

Fiscal.ai is primarily a web-based platform optimized for desktop use. While the website is mobile-responsive and functional on tablets and smartphones, there are no dedicated iOS or Android apps currently available. The complex nature of financial analysis typically benefits from larger screens anyway. Check our Delta or getquin who have dedicated apps to track your portfolio.

All investments carry risk, including loss of capital. EU Investing Hub does not provide investment advice. Content is for educational purposes only. Always do your own research.