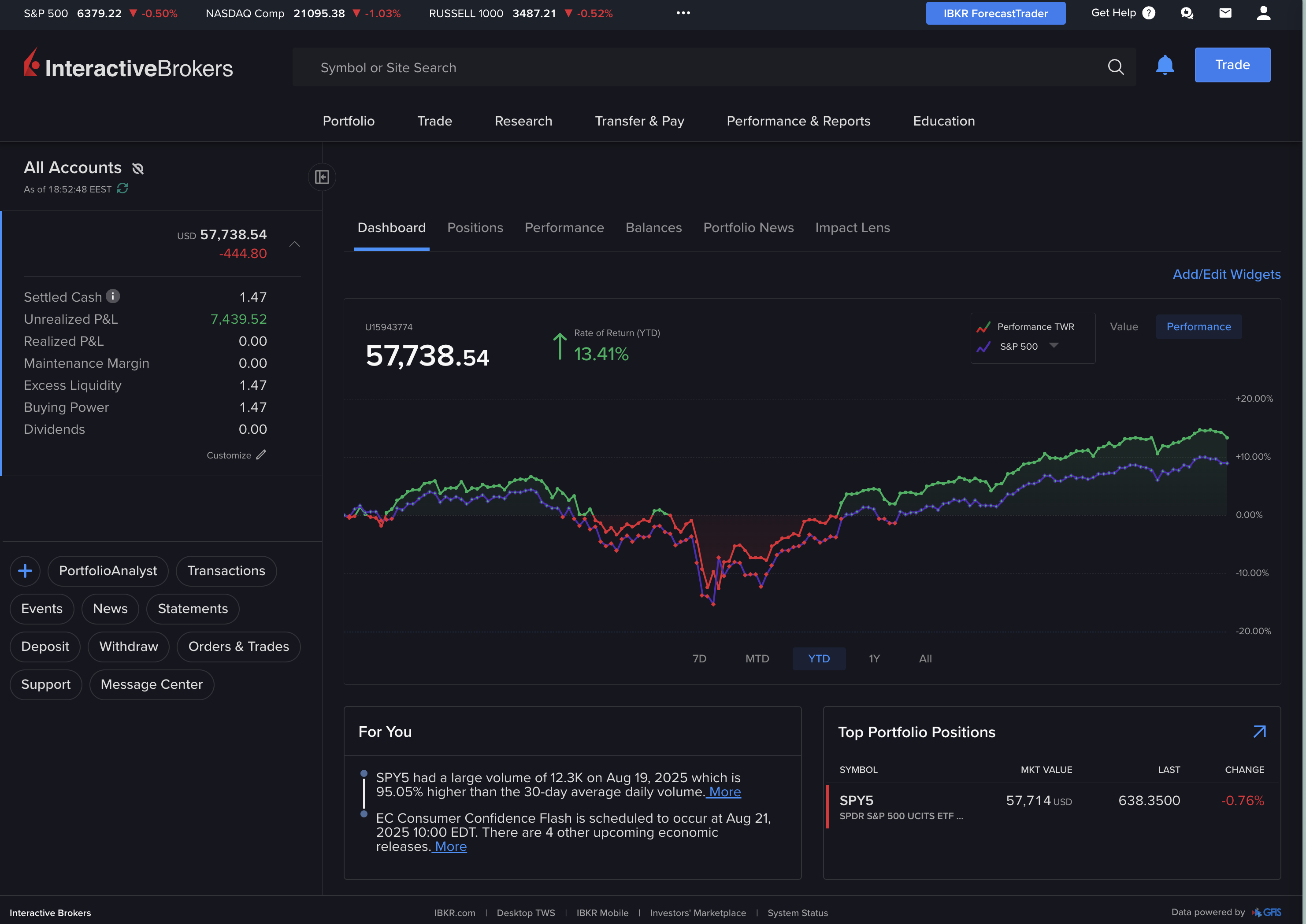

Interactive Brokers (IBKR) stands as one of the most established names in online brokerage, serving over 1.7 million accounts globally since 1978. For EU investors seeking professional-grade trading tools, global market access, and competitive pricing, Interactive Brokers presents a compelling option, though it comes with a steep learning curve that may deter casual investors.

What We Like

- Ultra-low trading costs across global markets

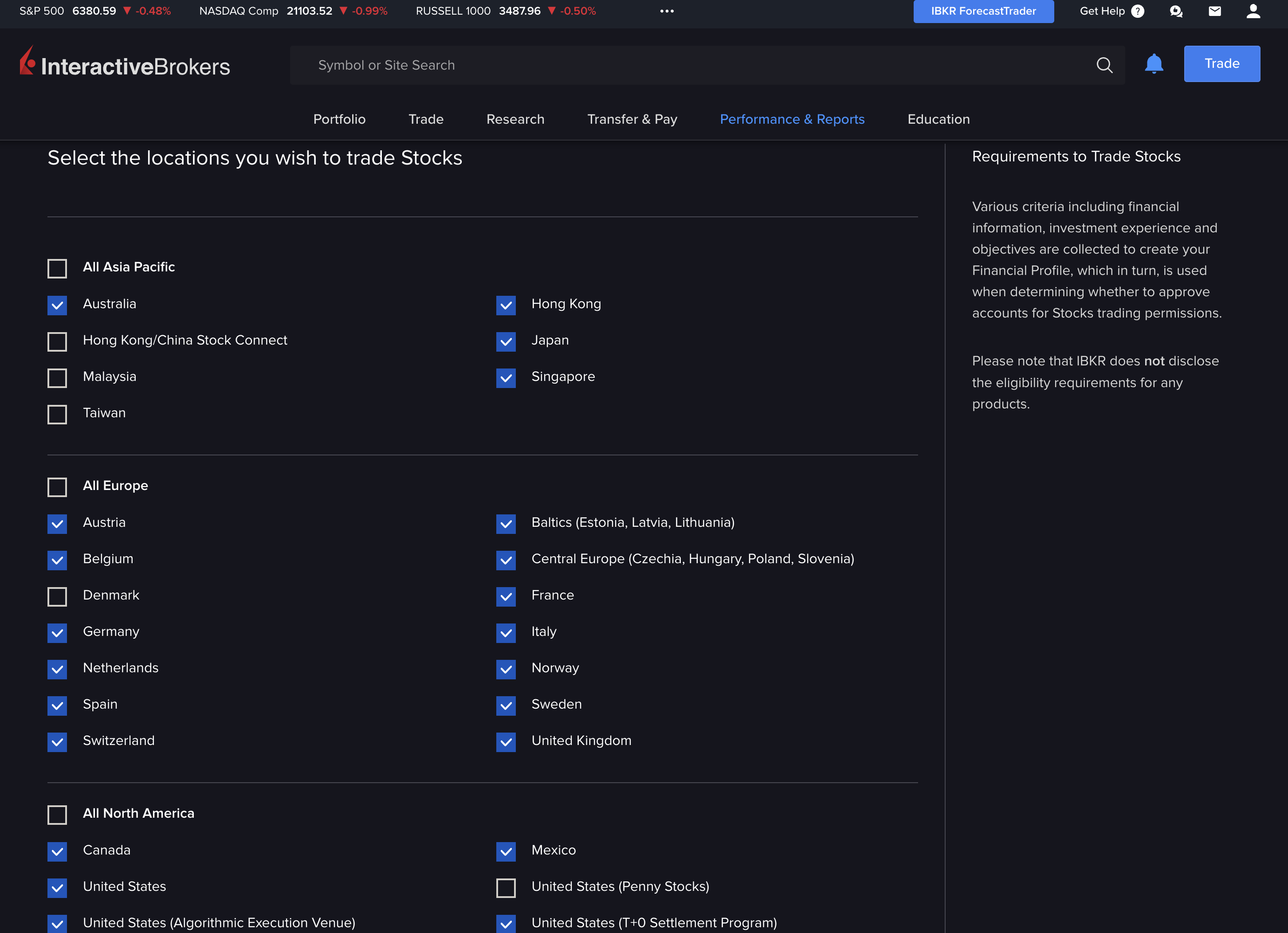

- Extensive market access to 150+ markets in 33 countries

- Professional-grade platforms including Trader Workstation (TWS)

- Strong regulatory oversight from multiple EU authorities

- Advanced order types and risk management tools

- Competitive margin rates starting from 5.83% APR

- No account minimums or inactivity fees

What We Don't Like

- Complex interface not suitable for beginners

- Steep learning curve for platform navigation

- Limited educational resources compared to retail-focused brokers (consider supplementing with external research tools like Seeking Alpha)

- No commission-free trading on IBKR Pro (though fees are minimal)

| Feature | Details |

|---|---|

| Regulation | FCA (UK), BaFin (Germany), CSSF (Luxembourg), CySEC |

| Founded | 1978 |

| Headquarters | Greenwich, Connecticut, USA |

| Markets Available | 150+ markets in 33 countries |

| Account Minimum | No minimum deposit |

| Trading Platforms | TWS, IBKR Mobile, GlobalTrader, Client Portal |

| Asset Classes | Stocks, ETFs, Options, Futures, Forex, Bonds, Crypto |

| Base Currencies | USD, EUR, GBP, CHF, JPY, AUD, CAD, and 12 others |

| Protection Scheme | ICS (Ireland) 90% up to €20,000, SIPC (US) up to $500,000 |

What Interactive Brokers Is Known For

Interactive Brokers has built its reputation on three core strengths: institutional-quality execution, comprehensive global market access, and transparent low-cost pricing. The platform caters primarily to active traders, investment professionals, and sophisticated investors who prioritize advanced tools over simplicity.

We found IBKR particularly strong in options trading, with some of the lowest options commissions in the industry and advanced analytics tools. The platform also excels in international diversification, offering direct access to European exchanges like Euronext, Deutsche Börse, and London Stock Exchange without complex ADR structures.

Fees and Pricing Breakdown

Interactive Brokers operates two main pricing structures: IBKR Lite (commission-free for US stocks and ETFs) and IBKR Pro (tiered or fixed pricing with better execution). EU investors can only choose IBKR Pro at this stage.

| Asset Class | IBKR Pro Fixed | IBKR Pro Tiered | Notes |

|---|---|---|---|

| EU Stocks | 0.05% (min €1.25) | 0.025% (min €1.25) | Highly competitive |

| US Stocks | $0.005/share (min $1) | $0.0005-0.0035/share | Industry-leading rates |

| Options | $0.70/contract | $0.15-0.65/contract | Volume discounts apply |

| Forex | 2-12 bps | 0.08-6 bps | Institutional spreads |

| Futures | $0.85/contract | $0.25-0.85/contract | Exchange fees included |

| ETFs | Same as stocks | Same as stocks | No additional ETF fees |

Use our ETF fee calculator to see how these costs compare with other brokers over time.

Additional Fees:

- Currency conversion: 2 basis points (0.02%) for amounts over $1 million

- Market data: Varies by exchange, many fees waived with sufficient trading

- Withdrawal fees: None for most methods

- Inactivity fees: Removed in 2021

Safety and Regulation Overview

For a detailed analysis of Interactive Brokers' security measures and investor protections, see our dedicated article on whether your money is safe with Interactive Brokers.

Interactive Brokers maintains robust regulatory compliance across multiple jurisdictions. EU clients are served by Interactive Brokers (U.K.) Limited (FCA regulated), Interactive Brokers Central Europe Zrt. (regulated by the National Bank of Hungary), and other EU entities.

The broker complies with MiFID II requirements, offering both retail and professional client classifications. EU retail clients benefit from additional protections including negative balance protection on CFDs and standardized risk warnings.

Trading Experience and Platform Quality

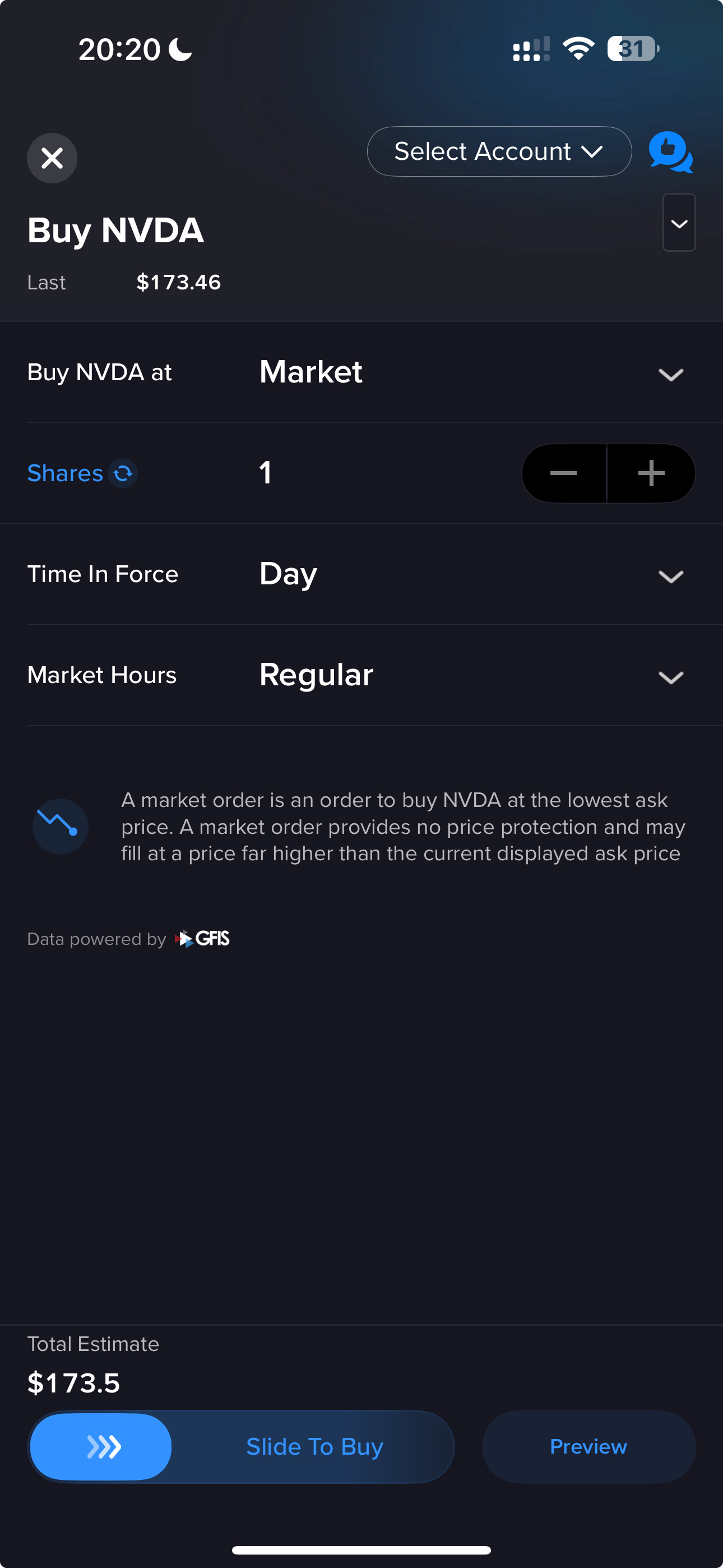

Interactive Brokers offers multiple platform options, with Trader Workstation (TWS) serving as the flagship professional platform. We tested TWS extensively and found it offers unparalleled depth for active traders, though the learning curve is substantial.

Platform Options:

- Trader Workstation (TWS): Desktop platform with advanced charting and order management

- IBKR Mobile: Full-featured mobile app with most TWS functionality (see our IBKR mobile apps comparison)

- GlobalTrader: Simplified web-based platform for casual investors

- Client Web Portal: Account management and basic trading interface

The account opening process typically takes 1-3 business days for EU residents, requiring standard KYC documentation. We found the process straightforward, though MiFID II compliance requirements add some complexity for retail clients.

Supported Assets and Global Market Access

Interactive Brokers provides direct access to more markets than virtually any other retail broker. EU investors can trade local European exchanges in their home currencies, avoiding currency conversion costs for domestic investments.

Available Markets Include:

- All major European exchanges (Euronext, Deutsche Börse, LSE, SIX Swiss)

- US exchanges (NYSE, NASDAQ, CBOE)

- Asian markets (Tokyo, Hong Kong, Singapore, Australian Securities Exchange)

- Emerging markets (India, Brazil, Mexico)

Asset Classes:

- Stocks and ETFs across all accessible markets

- Options on most major markets

- Futures and commodities

- Forex with institutional spreads

- Fixed income securities

- Cryptocurrency (Bitcoin, Ethereum, and 9 other coins through Paxos)

Customer Support and Educational Resources

Interactive Brokers provides 24/7 customer support during market hours via live chat, phone, and email. Response times are generally quick for account and technical issues, though investment guidance is limited in line with the platform's self-directed approach.

The educational offering includes webinars, trading tutorials, and market analysis, but we found it less comprehensive than retail-focused competitors. The focus remains on platform training rather than investment education.

Who Interactive Brokers Is Best For

Interactive Brokers excels for specific investor profiles:

Ideal Candidates:

- Active traders seeking low-cost execution

- International investors wanting global market access

- Options and derivatives traders

- Investment professionals and financial advisors

- Sophisticated investors comfortable with complex platforms

Not Suitable For:

- Complete beginners needing educational support (consider eToro or Trade Republic instead)

- Casual investors preferring simple interfaces

- Investors seeking robo-advisory services

- Those requiring extensive research and analysis tools

Things to Be Aware Of

While Interactive Brokers offers exceptional value for its target market, several considerations merit attention:

Market Data Costs: Real-time market data requires separate subscriptions, though fees are waived with sufficient trading activity. Budget €20-50 monthly for comprehensive data feeds. Though unless you are a real trader, for long-term investors this is not required. We do not pay for this service ourselves.

Platform Complexity: TWS overwhelms casual users with its extensive functionality. Plan time for platform training or consider the simplified GlobalTrader interface.

Final Verdict

Interactive Brokers represents the gold standard for cost-conscious active traders and international investors. The combination of ultra-low fees, global market access, and professional-grade tools makes it our top choice for sophisticated EU investors.

However, the platform's complexity and limited educational resources make it unsuitable for beginners. We recommend Interactive Brokers for investors with existing market knowledge who prioritize costs and functionality over simplicity.

Account Application

Complete online application with personal and financial information. Upload required documents for identity verification.

Document Verification

Submit government-issued ID, proof of address, and financial information. Process typically takes 1-3 business days.

Fund Your Account

Deposit funds via bank transfer, debit card, or other approved methods. No minimum deposit required.

Platform Setup

Download Trader Workstation or access web platforms. Configure market data subscriptions based on your trading needs.

Start Trading

Begin trading with access to 150+ global markets. Consider starting with the GlobalTrader platform if new to IBKR.

Frequently Asked Questions

Is Interactive Brokers safe for EU investors?

Yes, Interactive Brokers is highly regulated across multiple EU jurisdictions and maintains strong capital ratios. Client funds are segregated and protected under the Irish Investor Compensation Scheme (ICS) at 90% of losses up to €20,000 per investor. Securities held in the US receive additional SIPC protection up to $500,000 plus Lloyd's insurance coverage.

What are the minimum deposit requirements?

Interactive Brokers removed minimum deposit requirements in 2021. You can open an account with any amount, though you'll need sufficient funds to cover your intended trades and any applicable fees.

How much does real-time market data cost?

Market data fees vary by exchange but typically range from €1-25 per month per exchange. Many data fees are waived if you generate sufficient commission activity on the relevant markets.

Is Interactive Brokers suitable for beginners?

Interactive Brokers primarily targets experienced traders and investors. While the GlobalTrader platform offers a simplified interface, beginners might find better educational support and easier onboarding with retail-focused brokers like Revolut or Lightyear.

What's the difference between IBKR Lite and IBKR Pro?

IBKR Lite offers commission-free US stock and ETF trading but with potentially slower execution and higher margin rates. IBKR Pro charges small commissions but provides superior order routing, lower margin rates, and access to all markets and order types. At this stage European investors can only choose IBKR Pro.

How does Interactive Brokers compare for European stock trading?

Interactive Brokers offers some of the lowest commissions for European stock trading, with tiered pricing as low as 0.025% of trade value. The platform provides direct access to major European exchanges in local currencies.

When investing, your capital is at risk. This marketing content is provided by a paid Influencer of Interactive Brokers. Influencer is not employed by, partnered with, or otherwise affiliated with Interactive Brokers in any additional fashion. Influencer is a customer of Interactive Brokers. Interactive Brokers and Influencer have entered into a cost-per-click agreement under which Interactive pays Influencer a fee for each clickthrough of the Interactive Brokers URL posted herein. This content represents the opinions of Influencer, which are not necessarily shared by Interactive Brokers. The experiences of the Influencer may not be representative of other customers, and nothing within this content is a guarantee of future performance or success. Interactive Brokers provides execution and clearing services to its customers. Interactive Brokers makes no representation and assumes no liability to the accuracy or completeness of the information provided in this Influencer communication. None of the information contained herein constitutes a recommendation, offer, promotion, or solicitation of an offer by Interactive Brokers to buy, sell or hold any security, financial product or instrument or to engage in any specific investment strategy. Investing involves risks. Investors should obtain their own independent financial advice and understand the risks associated with investment products and services before making investment decisions. Risk disclosure statements can be found on the Interactive Brokers website.

.png)